SERVICES FOR CREDIT UNIONS

Does your credit union provide members maximum value? Members either draw from their own financial literacy or they rely on suggestions from your frontline employees. Credit union employees must understand members’ financial literacy in order to help them select the right products and services.

The Pivotal Link knows credit unions. We know that sales training can distort the credit union philosophy and overemphasize numbers and incentives. While the numbers are important, they don’t always encourage the most effective behaviors.

THE PIVOTAL LINK KNOWS MEMBERS

We know why members don’t use everything the credit union has to offer. Our approach to financial wellness will be the pivotal link between employees living your mission versus them being mere clerks. Driving sales requires employees who understand all components of a member’s financial literacy, not just what products to sell.

THE PIVOTAL LINK KNOWS TRAINING

We have developed a Financial Wellness Mentoring Program that will transform how your employees help your members. They will move beyond being order takers and referral counters, to partnering with your members to ensure they have a trusted advisor looking out for their financial future. We also provide emotional intelligence training that provides managers the tools necessary to optimize their effectiveness with employees and members.

SIGNS OF SALES TRAINING GONE AWRY:

1.Inconsistent employee referrals

2.Few employees reach sales and referral goals

3.“Four more referrals and you’ll hit your goal!”

4.It takes incentives to hit goals

5.Dormant and under-utilized accounts

WHAT WE DO

We work with a core group of your management and sales employees to create a team that not only understands the credit union philosophy of people helping people, but lives it. Your team will become elite personal mentors that your members will trust to help improve their financial wellness. This life changing relationship will become a beacon of hope in your community. Working with The Pivotal Link is good for business, good for the community, and creates real social capital.

We take traditional sales training to the next level. Your employees will learn why people have financial troubles and how the credit union can be their solution. Our Financial Wellness Mentoring Program is the link that connects employees to members.

HOW WE DO IT

We provide research-based training that includes and goes beyond understanding products and services. Your elite team will become more than mere dispensers of financial knowledge. The Financial Wellness Mentoring Program ensures that they become learning facilitators working with members to help them achieve personal financial health and wellness. Team members will learn to develop a customized approach for each member, addressing both immediate needs and future goals. This personalized approach creates trust and increase the members’ likelihood of choosing your credit union as the primary solution to their financial needs, health, and wellness. Your credit union will become known for its ability to engage your community by becoming the trusted resource it needs.

We provide a Financial Literacy Assessment for your members that will help guide your elite team to customize their approach and connect with each member in a way they never thought possible.

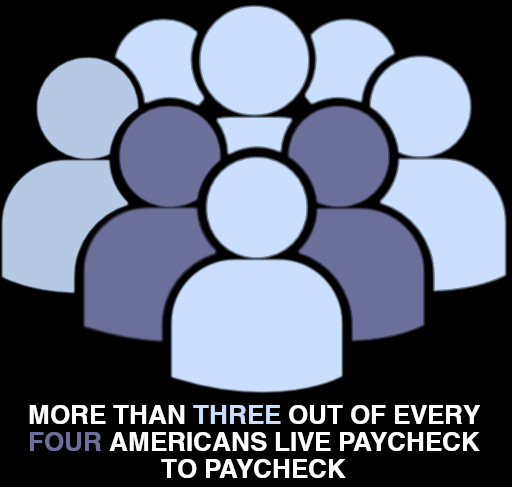

Source: Forbes

WHY WE DO IT

We believe in the credit union movement. Your credit union is a part of a community. There are people in your community that need help, guidance and a trusted partner to help lift them out of their financial struggles and provide hope. Our job is to create a link between credit unions and their community so both can thrive.

We utilize credit unions and advocate for their use when we work with social services agencies. Credit unions are not just clients for us, they are valuable community partners.