FINANCIAL LITERACY TRAINING FOR SCHOOLS

Most young adults learn about finances and money the hard way—from used car dealers and loan sharks. They learn from unforeseen crises. By the time they have the information necessary to build a solid financial foundation, they’ve already developed attitudes, habits, and behaviors that may or may not serve them well. Our research shows that most young adults struggle at all levels of financial literacy.

The Pivotal Link knows financial wellness and literacy. Our job is to empower our partners with knowledge. Learning about financial products and services is not enough. Understanding financial wellness and literacy requires a critical inspection of our attitudes and behaviors regarding money. The Pivotal Link provides a research-based assessment for every student so they can begin their journey to a better financial future—no matter their starting point.

THE PIVOTAL LINK KNOWS STUDENTS

Our team has over 100 years of education background working with students in middle school, high school, and college. Our approach is highly interactive and builds on the lives and experiences of the students. We honor their background and provide material that engages them to be fully active in the learning process.

THE PIVOTAL LINK KNOWS INSTRUCTION

Our experiential approach ensures students walk away empowered to make more effective financial decisions for life. The curriculum is hands on, with group activities driven by student experiences.

EQUITY AND OPPORTUNITY

Students are vulnerable to financial pitfalls and often rely on their parents’ levels of financial literacy to inform their own. Unfortunately, this can lead to cycles of poor financial decisions and a lifetime of struggles. We believe in equity and opportunity.

Not all people are given the same advantages at birth. Pulling yourself up by your bootstraps is a myth in the face of the insurmountable barriers many students face. Our job is to provide the tools to level the playing field and empower students to take charge of what they can control.

Financial literacy is not a silver bullet that will slay inequality, but it is a pivotal link to realizing that goal.

WHAT WE DO

We provide research-based training that includes and goes beyond understanding products and services. Our Financial Literacy Assessment will help inform your students of any attitudes or behaviors that might be limiting their current and future ability to enjoy a sense of financial wellness. We introduce them to key financial products and services, and deepen their understanding of how they work.

Most importantly, we teach students how financial literacy affects their long-term and short-term goals, and how it impacts their role in society.

HOW WE DO IT

Our customized course meets the needs of your school and students. We offer a multitude of course designs that allow you to pick from short-term or long-term courses depending on the structure of your schools’ classroom schedules.

We work with public schools, private schools, charter schools, and any other educational institution seeking to provide students with a lifetime of financial empowerment.

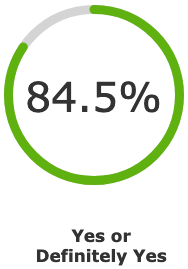

Americans who believe financial literacy should be taught in school

WHY WE DO IT

We believe that our expertise can be extended to students in unique ways. All school faculties work hard to provide students with opportunities and The Pivotal Link can help supplement your efforts by providing hands-on, interactive courses that go beyond a typical finance class. We want to help teachers and students provide a complete education regardless of the challenges your community may face.