SOCIAL SERVICES AGENCIES

Your community depends on you to provide pivotal services for clients. Teaching financial literacy is a key service to help individuals climb out of financial distress.

Social services agencies are always overburdened. There’s too much to do and not enough people to do it. We work with both employees and clients to lessen the load on agencies by providing individuals with the necessary tools to take agency over their financial future.

IT’S PERSONAL

We have seen the impact financial literacy has on both individuals and communities. Bringing financial literacy to our communities means bringing opportunities to our friends, neighbors, and those in need. At The Pivotal Link, we strongly believe that the path to a more equitable society requires a more equitable distribution of knowledge. Teaching financial literacy does more than lift up individuals. It lifts up entire communities.

STUCK IN A HOLE? PICK A TOOL.

The shovel.

This tool’s inextricable connection to holes makes it an intuitive choice. After all, we’ve all heard that you’ve got to spend money to make money.

But the only way out of financial distress is to reevaluate what we’re doing and take active steps to initiate change. It starts with putting down the shovel.

The ladder.

This tool helps you get out of a hole. It may seem like overkill at times. It may seem a bit too straight and rigid. It certainly isn’t convenient. But if you’re stuck in a hole, a ladder will get you out.

Financial literacy is the ladder that will allow your clients to climb out of financial distress.

YOUR TEAM

We work with your team to teach the principles of financial literacy and how it directly impacts your clients. While you clearly understand your clients on a personal level better than anyone else, we highlight the mechanics of financial behaviors and how a better understanding of these mechanisms allows you to better serve your clients.

Working with The Pivotal Link, we’ll connect your employees to reputable financial institutions and services that can help your clients reach financial stability. We’ll teach you to identify when financial distress has been exasperated by a lack of financial literacy and how to communicate with clients about these issues.

YOUR CLIENTS

We work directly with your clients to assess their financial literacy and improve it. Our individualized scores allow us to easily identify how we can help improve your clients’ financial literacy and improve their lives.

Our communities are rife with businesses that will take advantage of individuals with low financial literacy. “Buy here pay here” car lots. Risky title loan businesses. For individuals without bank accounts, just cashing a paycheck is a costly endeavor.

We help your clients change their financial behavior in ways that allow them to stop spending and start saving. We provide the ladder so all they have to do is climb out.

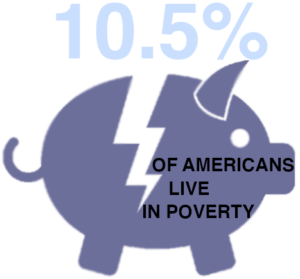

Source: U.S. Census Bureau

OUR COMMUNITY

Your clients are more than just clients. They’re our community. The financial well-being of a community is composed of the individual financial well-beings of its members. At The Pivotal Link, we believe that raising up the most disadvantaged in our community benefits everyone. Plus, it’s just the right thing to do.

Contact us today to see how we can work together to strengthen our communities by making financial literacy as ubiquitous as literacy.